BTC started last week strong on the aversion of the US government shutdown, coupled with market enthusiasm for the first ETH spot ETFs to be launched.

Thus, BTC extended its Sunday rally and swiftly swept liquidity above $28,550 during the US session.

Market expectations were high, with many traders positioned long to front-run anticipated big interest for ETFs and resulting money flow.

However, as ETF trading kicked off, the demand turned out to be low, so enthusiasm waned and the market went down.

Falling equities and rising yields were adding to the downward pressure for the rest of the day on Monday and also Tuesday.

Stronger JOLTs on Tuesday contributed to that.

As a result, BTC retraced most of its pump to get to $27,150 where it started to be bouncy.

Judge rejected SEC’s motion to appeal Ripple ruling on Tuesday, giving XRP the boost but also supported the crypto market, including BTC.

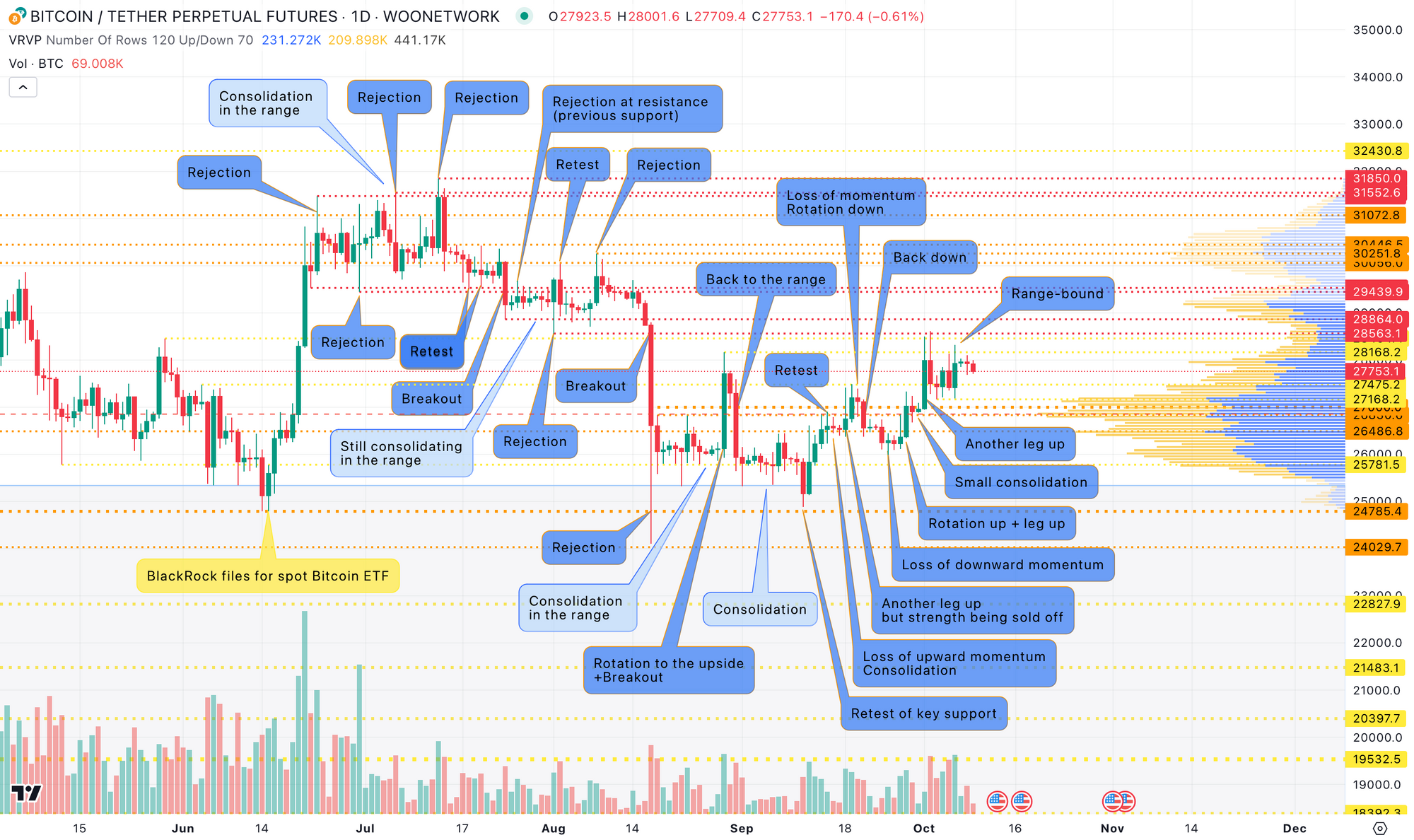

We’ve seen the market moving back and forth intraday in the range set by Monday high and Tuesday low for the rest of the week.

Even much stronger NFP on Friday caused only some initial selling towards the bottom of that range, but it was reversed by the end of the day helped by the bounce in US equities before the weekend.

The Middle East situation after the Hamas attack on Israel on Saturday didn’t cause much of a reaction on BTC.

Eventually BTC finished the week almost exactly where it started.

As we noted last week, we would need to see daily close on BTC above $28,000 and ideally above $28,550 to get out of the range and be confident about the long side.

It hasn’t materialized yet, so the situation on BTC remains changed.

As such, the preferred approach remains level to level trading in the range and looking for short-term opportunities, with most of them being intraday.

We see a lot of stops chasing in lower time frames so trading against them works quite well.

For long-term traders, it’s still a wait-and-see game now.

It’s positive for bulls that since the lower band retest at $24,800 on Sep 11, we’ve been trending up towards the upper band, and even though we haven’t managed to break it, we are still consolidating just below.

It’s important for $27,150 (last week low) to hold now.

However, if BTC manages to break it, we can see deeper pullback or even target range low of $24,800 with first levels to watch on the way at $26,800 and $26,000.

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.