Stablecoins are growing, but is it a sign of something for traders?

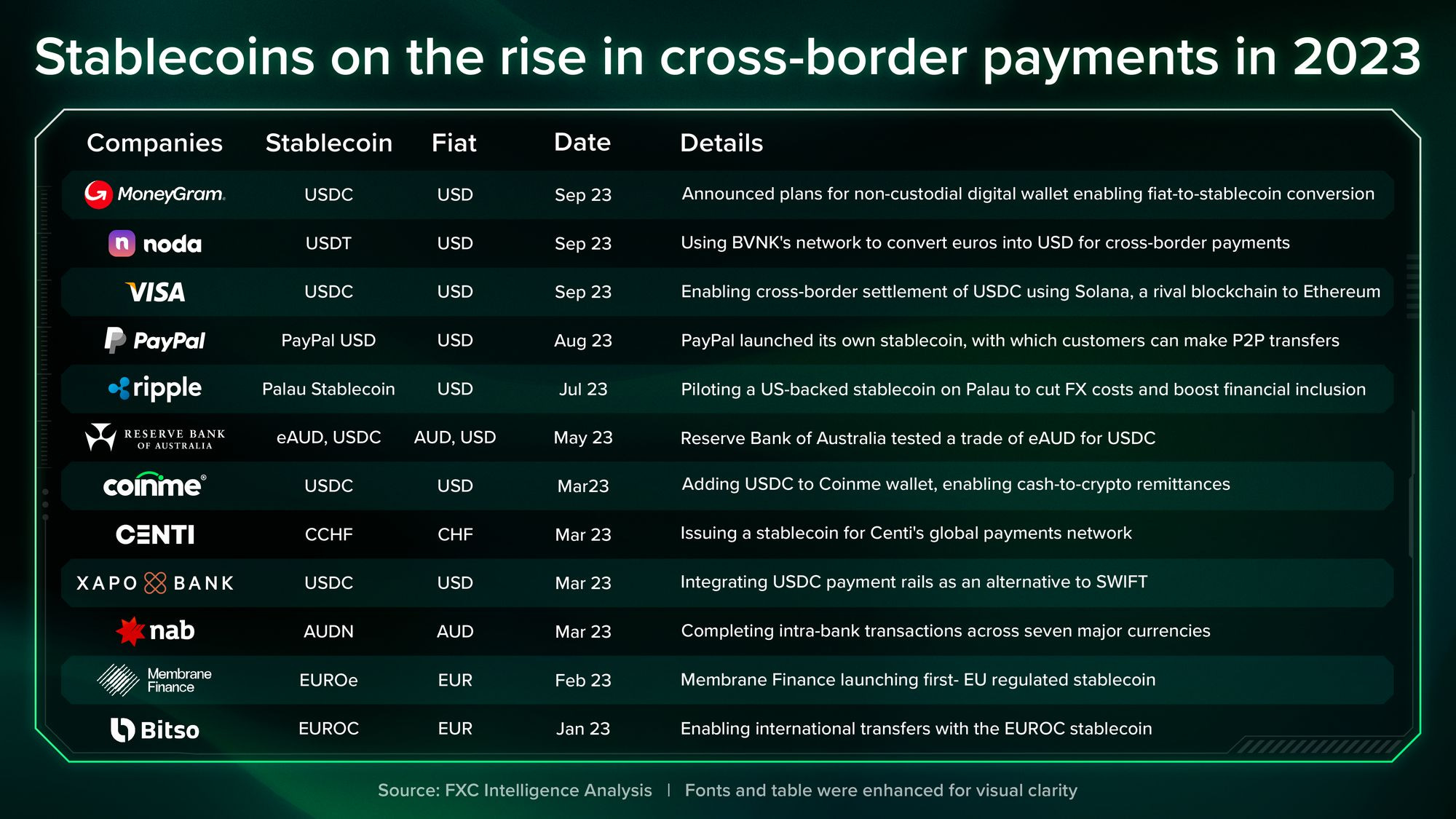

Stablecoins, initially hit by a downturn since the TerraUSD peg incident in May 2022, are showing resilience and growth in 2023, notably in cross-border payments, data from UK-based FXC Intelligence showed.

Joe Baker, from FXC reported that despite market volatility, major players in the payments industry, including MoneyGram, Noda, and Visa, are forging ahead with stablecoin-related initiatives.

Despite ongoing market fluctuations, leading payment companies are positioning themselves for future demand in stablecoin transactions. Visa, for instance, has expanded its stablecoin settlement capabilities by partnering with Worldpay and Nuvei and integrating with the Solana blockchain.

However, Baker noted that PayPal's entry into stablecoins has faced slow adoption compared to established stablecoins like USDT and USDC. His report also highlighted that while USD-backed stablecoins, notably Circle's USDC, dominate cross-border projects due to the US dollar's strength, initiatives in Asia-Pacific and Europe are exploring stablecoins' cross-border potential, with growing interest in emerging markets for financial inclusion.

Baker said that stablecoins still grapple with challenges, notably the risk of losing their peg. Regulatory efforts in the US and EU continue to evolve, adding an element of uncertainty to payment companies' investments in this space.

Should traders care?

In giving his insights on the FXC data, WOO Senior Analyst Marek Chajecki underscored the optimism surrounding the adoption of stablecoins and cryptocurrencies by global payment companies.

Chajecki said that while short-term challenges exist due to regulatory pressures, the long-term outlook appears positive as the industry moves towards a more robust and regulated ecosystem.

“From traders’ perspective, it should help improve liquidity and prevent manipulative practices making crypto behave like more mature traditional markets,” he noted.

“The fact that global payment companies have been getting increasingly involved in stablecoins is good news for crypto as it should help support crypto adoption both from the institutional and retail side,” he said.

It's worth noting that this trend persists despite regulatory headwinds, which, in the short term, may have a dampening effect on the market. “Regulatory compliance often involves substantial costs and may force many market participants, who currently benefit from the unregulated and flexible environment, to make adjustments or exit the market,” Chajecki explained.

However, Chajecki believes that in the long run, this regulatory direction will yield positive outcomes by establishing a secure and stable environment for market participants. “Recent actions by major global players signify their confidence in the future of stablecoins and cryptocurrencies as a whole. They are positioning themselves early to gain a competitive edge when adoption rates surge and the market matures.”

—

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.