Q1 of 2021 witnessed a major transition in terms of growth on both the product side as well as the community. To provide more transparency to our community and investors, Wootrade has prepared the second quarterly report, sharing insights on the different areas of development.

- $49m in average daily volume, up 337% from Q4 2020

- Daily high of $111m, up from $73 million in Q4

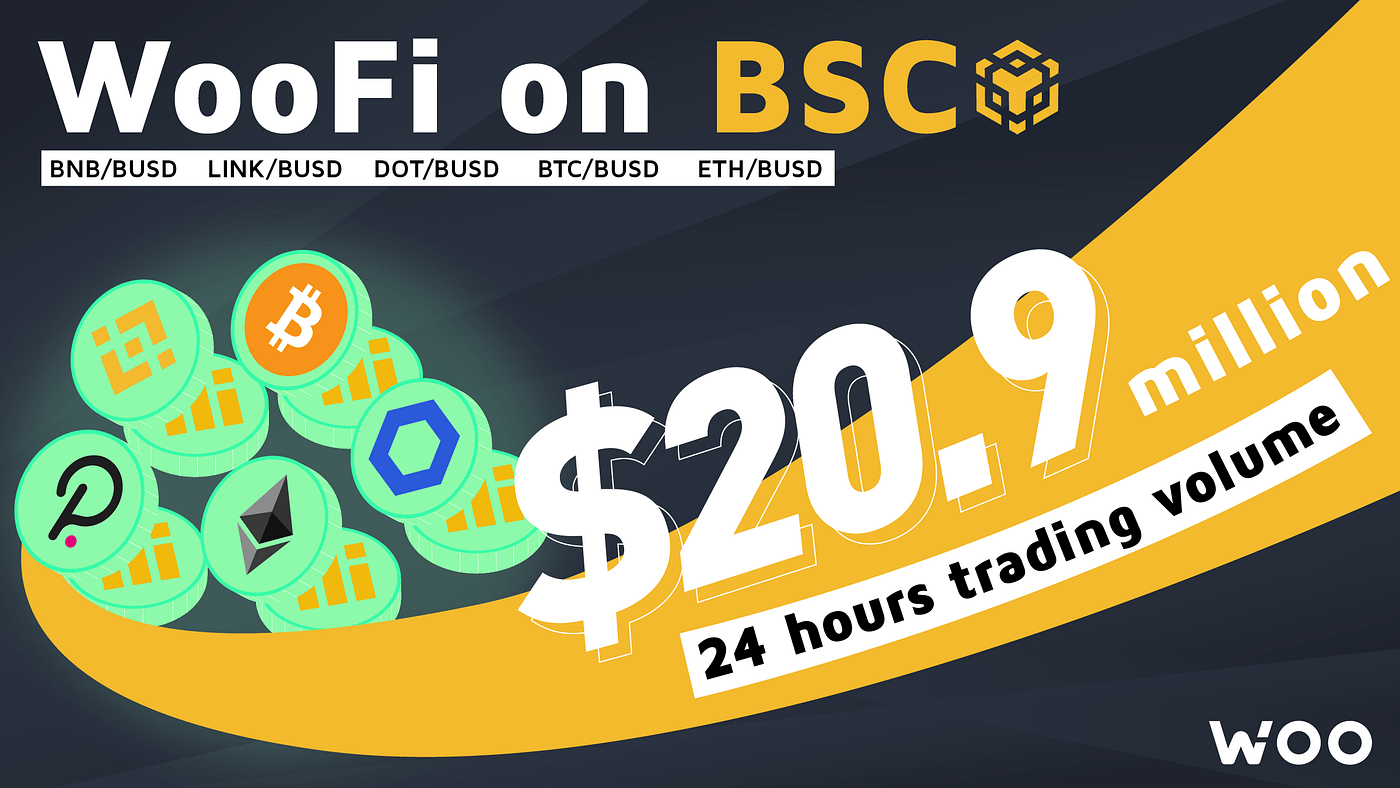

- 5 DeFi swaps added on BSC with a daily high of over $20 million

- 6.6m WOO tokens bought back and burned

*All statistics in this report are accurate as of April 8, 2021.

The WOO Token

Quick token insights:

- The circulating supply is now 408,196,106 of a total 2,993,908,889. With a roughly $340m market cap, the WOO token is now ranked around #180 on Coingecko.

- Q1 saw unique addresses on Ethereum increase from 787 to over 4000.

- The bulk of WOO is still held on exchanges, with about 201m WOO (49% of the circulating supply) held by users on Huobi, AscendEx (Formerly BitMax), MXC, and Gate.

- Around 25% of WOO on exchanges are held in long-term staking programs. There is an estimated 31m staked on AscendEx and 19m staked on WOO X, along with 3.6m on DEXs (SushiSwap and Uniswap).

According to the chart above, address holders of all sizes have been increasing. The most common holding amount (denominated in WOO) was 1,000 to 10,000 (1532 of 4028 total addresses) with the second most common being 10,000 to 100,000 (928 of 4028 addresses).

Previously, 50% of the original token supply had been reserved for “Ecosystem Rewards.” Wootrade has now specified what the 50% is used for, including:

- 25% WOO rewards, allocated to incentivize network usage

- 10% Insurance fund, to back user assets on the network

- 10% Ecosystem partners, to reward partners for supporting activities

- 5% WOO Ventures, to invest in early-stage projects with benefits going to token holders

WOO Ventures to invest in projects providing strategic value to Wootrade, will share rewards with…

Benefits to be distributed partially among WOO token holders, sharing the value throughout the ecosystem

medium.com

Inflationary statistics

In total, about 160m WOO tokens were added to the supply during the quarter.

The biggest contributor to inflation over Q1 was the vesting of private sale tokens, which has now been completed as of March 31. Throughout Q1, roughly 107m WOO were claimed from the Private Sale 1 smart contract, and 15.5m WOO were claimed from the Private Sale 2 smart contract. The seed sale smart contract, which is vesting over two years, had 29.5m WOO claimed from the contract.

3m tokens were lent to institutional staking clients, producing interest earnings of around 95,000 WOO tokens which were returned to the locked wallet. Another 5m WOO was used throughout the quarter on miscellaneous outgoings including ecosystem staking rewards, ecosystem partner payments, and exchange promotions and contests.

Burn statistics

Each month, a portion of revenues are used to buy back WOO tokens on the open market, which are sent to the designated burn address.

Monthly burn amounts:

- January: 5,247,767 WOO

- February: 817,564 WOO

- March: 537,166 WOO

- Total for Q1: 6,602,497 WOO

Technology and milestones

Wootrade’s trading platform, known as WOO X (Beta version), was released on x.woo.network. WOO X Beta will be onboarding users throughout Q2, with an official launch planned for mid-June.

Currently, 22 assets are available for trading, with new tokens to be added on a regular basis.

A number of other technical changes were implemented:

- Overall system performance was optimized with better order routing and a more effective order matching mechanism,

- WebSocket services were implemented

- WOO X deposit and withdrawal modules were optimized, and Wootrade’s withdrawal speed increased

- WOO X Help Center was established

- WOO token staking was enabled

On the DeFi side, WooFi was born. WooFi uses the same logic as Wootrade’s original CeFi strategies: Putting pooled capital on-chain and providing the lowest fees and best price execution to other DeFi routers and aggregators. Currently, there are five pools on Binance Smart Chain (BSC): BNB/BUSD, LINK/BUSD, DOT/BUSD, ETH/BUSD, and BTC/BUSD. The BNB/BUSD pool address is listed below, and users can observe the rate of transactions hitting the smart contract:

https://bscscan.com/address/0x0fe261aeE0d1C4DFdDee4102E82Dd425999065F4#tokentxns

DeFi represents a massive market for trading volume. More users are becoming comfortable with the technology and as the infrastructure improves, volumes are skyrocketing. By capturing a piece of this market, Wootrade can direct more value to both users of the network and WOO token holders.

Organizational notes

In the past quarter, the number of full-time Wootrade employees has increased from 30 to 41.

New hires in Q1 2021 include:

- 2 Frontend Engineers

- Quality Assurance Engineer

- Backend Engineer

- 2 Product Managers

- Operation Manager

- Legal Counsel

- Recruiter

- AML Officer

- Office Manager

Despite the additions and expenses, Wootrade achieved a net income positive status in January of 2021. This implies greater stability as the company no longer needs to rely on third-party investment or token sales to fund operations.

Community information

The Wootrade community had an impressive performance on social media this quarter, growing the Twitter community from 11.5k followers to 15.6k.

Telegram growth, by community:

Global (English) 🇬🇧 +26.5%

Vietnamese 🇻🇳 +66.7%

Turkish 🇹🇷 +56.3%

Spanish 🇪🇸 +56.5%

Russian 🇷🇺 +18.7%

In addition, Wootrade added Telegram communities in Taiwan, India, Indonesia, Poland, and French language.

Future Outlook

Despite the rapid growth, the goals remain consistent:

- Acceleration and Execution: Increase volume and other business metrics on the Wootrade network via onboarding clients and partners. Q2 will have two new growth drivers: Users on WOO X and on-chain pools (DeFi).

- Transparency and inclusion: Priorities include showing details of the platform and engaging openly with users throughout the WOO X Beta and official launch periods.

- Diversity and community growth: Attracting a larger pool of community members, token holders, and platform users in various regions including English-speaking regions, Latin/South America, Taiwan, Vietnam, Turkey, Russia, and Eastern Europe.

Above all, Wootrade aims to deliver high-quality products that provide traders with the best possible user experience. WOO X Beta is a positive first step, but a lot of work and innovation remains to differentiate Wootrade and expose its products to a wider audience of active users.

Connect with us on social media! Here are all the links you might need for more information:

- Reddit: https://www.reddit.com/r/WOO_X/

- Website: https://woo.network/

- Twitter: https://twitter.com/wootraderS

- Telegram: https://t.me/wootrade

- Telegram Announcements: https://t.me/WOOTRADEann

- Medium: https://medium.com/wootrade