Onboarding more liquidity providers as efforts to diversify and bolster liquidity continue

WOO is gearing up to expand its designated market maker (DMM) program to spot markets. This introduction, which will take place in January, will be one of the final stages as WOO X transitions from a single-market maker model to a more sustainable and conventional model.

WOO X has begun working with leading market-making teams to prepare for this transition.

"After successfully collaborating with WOO X on implementing a sustainable and open DMM model for perpetuals, we are now starting to look at optimizing their infrastructure and technology for spot markets as well,” said Jordi Alexander, CIO of Selini Capital.

“We appreciate the proactiveness and transparency that the team operates with, and we are hopeful that WOO X will soon be recognized as one of the most preferred trading venues."

Bringing diverse liquidity to perps

In August of 2023, WOO X introduced the DMM model on perps, which today accounts for nearly 80% of all maker volume on perpetual futures markets, and led to working with industry leaders like Wintermute and Selini Capital.

Liquidity from DMMs has reduced spreads significantly on WOO X, leading to one-tick spreads on majors like BTC and ETH perps. The success of this rapid transition has pushed the team to speed up expansion to the 100+ spot markets also listed on WOO X.

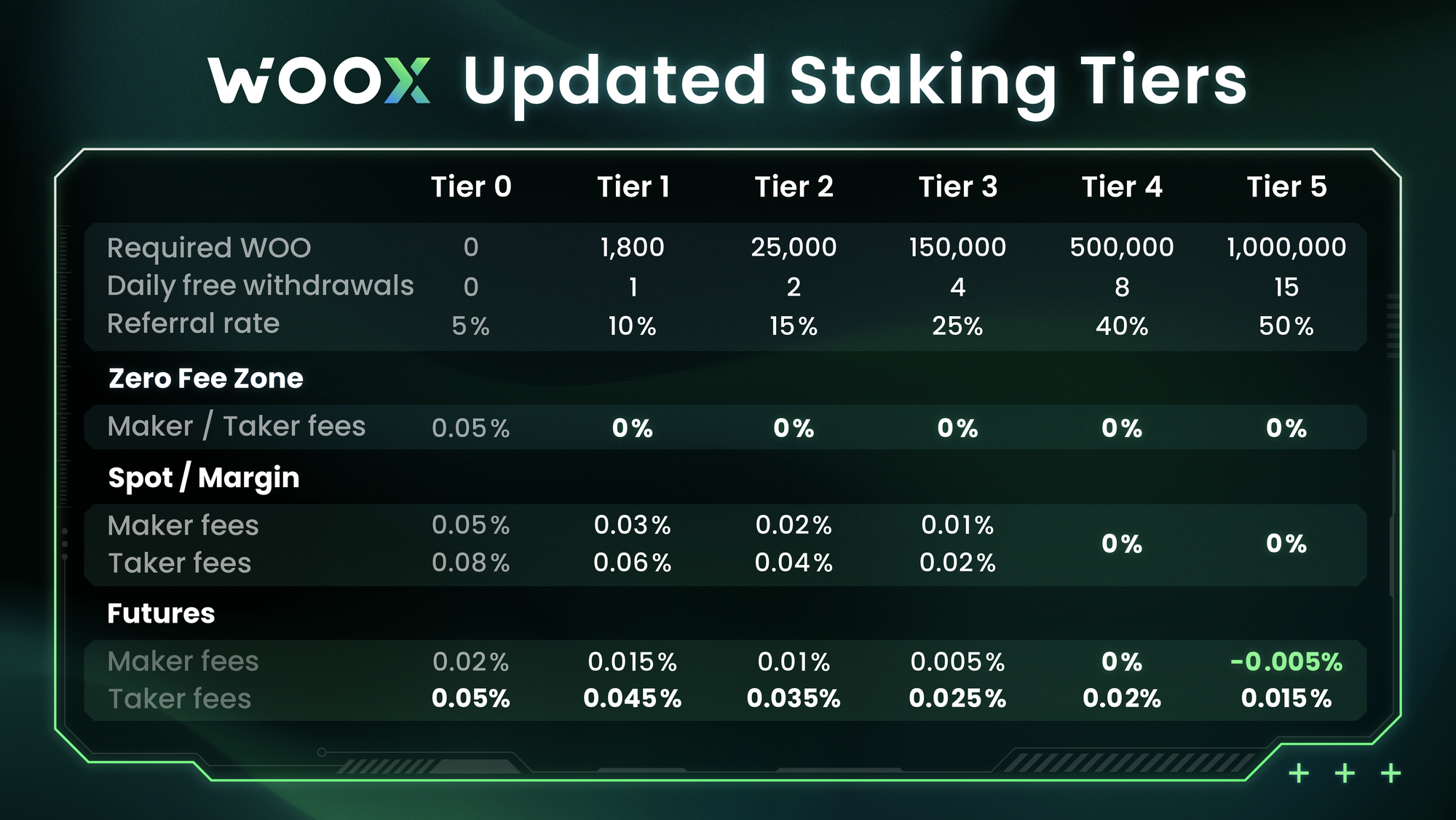

Rebates for high-tier stakers

WOO X will provide a 0.5 basis point maker rebates on perpetual futures maker for Tier 5 stakers. This incentive is geared towards traders or teams that want to receive incentives for providing liquidity without the commitment of competing as a DMM. This update is designed to provide further utility to large stakers and encourage users to stake to higher tiers. The change will be reflected as of December 21 at approximately 10:00 AM UTC, with rebates being distributed in USDT, in real-time, as the transactions happen.

By diversifying liquidity providers and leveraging our designated market makers on spot markets, WOO X aims to achieve a 100% custody ratio by Q2 of 2024. This commitment to eliminating reliance on a single market maker model and achieving a 100% custody ratio demonstrates our progressive approach, ensuring a sustainable and trust-driven ecosystem for its trading community.

DMMs interested in getting involved on spot or perps can explore our dashboard and connect with us directly. Feel free to reach out if you're interested!

-

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.