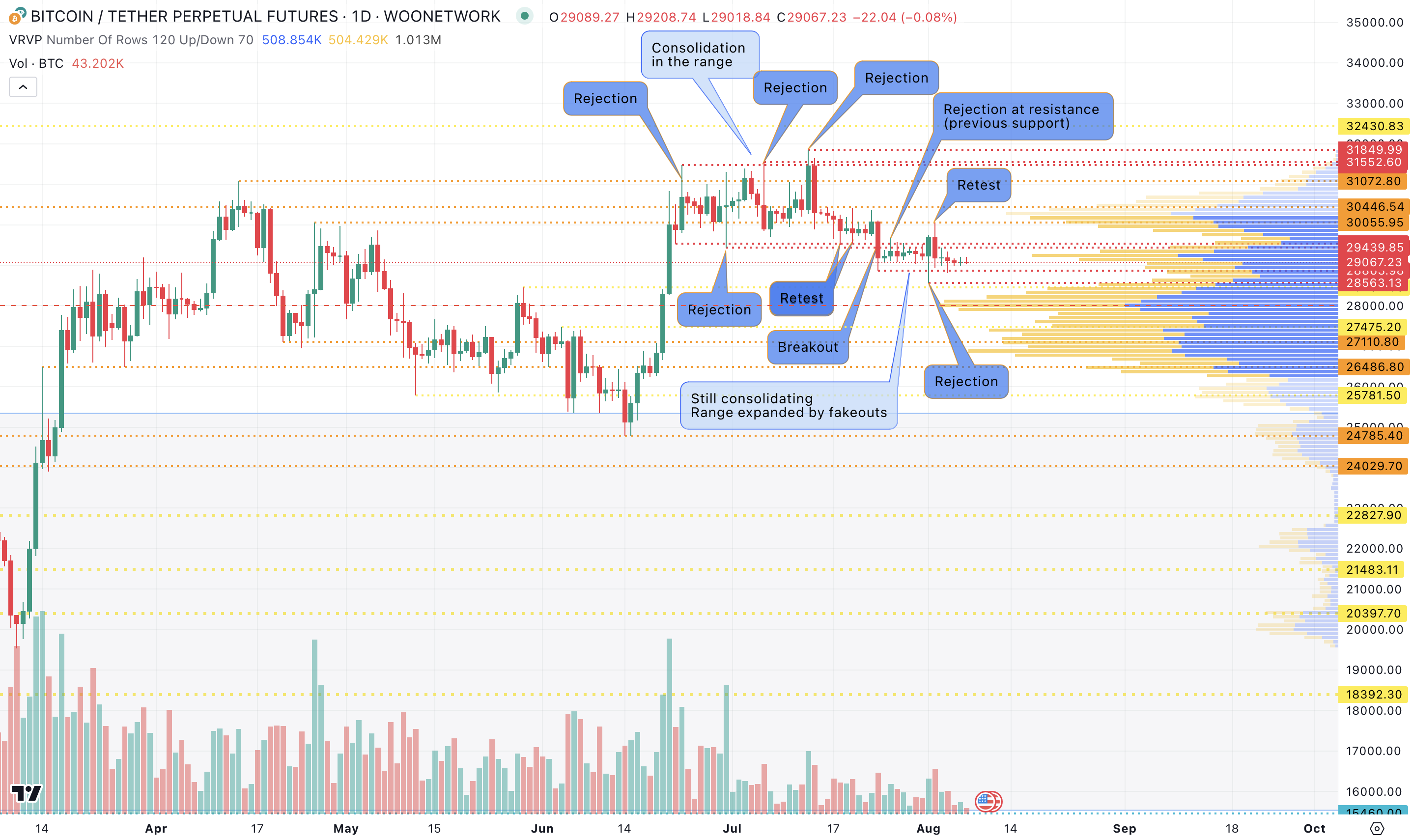

Bitcoin still in sleepy mode with no major changes in the longer-term picture and waiting for an eventual directional resolution

BTC started last week trading just below $29,500, which had been working as an important support before it was broken and flipped to resistance in the week before.

Throughout the day on Monday, the market was slowly but steadily pressed down, helped by an FT article saying that Coinbase was asked by the SEC to halt trading in everything except BTC.

Curve’s exploit on Sunday also weighed down the crypto market.

Eventually on Tuesday, BTC dumped to break the previous week low, but after swiping liquidity below, it came back to trade around that level.

In the US session, we had an attempt to post another leg down, but again a new low (printed at $29,563) was bought and this time even more aggressively, which led to a short squeeze.

Later, Fitch downgraded US long-term rating to AA+ from AAA, which caused a selloff on equities and treasuries (pushing yields up) and while it didn’t affect BTC much initially, it was supported as alternative investment to US assets.

It eventually went further up, helped by a bullish announcement from Microstrategy about planned big BTC purchases (with $750M stock sale for that purpose), which added fuel to the fire and extended short squeeze.

It broke $29,500, psychological level of $30,000 and got to as high as $30,041 on Wednesday, driven by bullish enthusiasm.

It looked like the market got in front of itself, which means it moved too far too quickly with retracement (sometimes even reversal), likely in such a situation.

And that’s what happened as BTC was pressed down in Asian and European sessions.

In the US session, the move accelerated to cover a big part of Tuesday's pump once the news came out about the DOJ considering fraud charges against Binance.

The initial sharp reaction down was bought and BTC traded around the middle of the range set by Tuesday’s low and early Wednesday’s high - not only till the end of Wednesday but also till the end of the week.

Even job data on Friday didn’t affect the market much.

July NFP came out softer than expected, but the unemployment rate was lower and average hourly earnings higher, which made the data mixed.

Initial strength on the release was later sold off, but the move wasn’t big enough to change the market picture much. Eventually, BTC finished last week slightly lower.

The situation on the market still remains indecisive, not only for long-term traders but also for swing traders with trading horizons longer than one day.

Not much has changed in recent weeks and there is no clear direction.

It’s a game of patience now.

BTC isn’t giving much confidence and doesn’t present good R/R opportunities - it’s been grinding down with lots of absorption at new lows and occasional short-squeezes.

There are some opportunities in a lower timeframe but it requires a lot of flexibility and patience at the same time, with the ability to switch on and off as some days are quite busy (like Tuesday or Wednesday last week) but others quiet with even a $100-150 daily range (like last Saturday).

It's a highly speculative market chasing liquidity and driven by short-term leveraged positioning and corresponding stops/liquidations.

Retail stops work as big traders’ entries and low liquidity is used to push the market to trigger them, which is reflected in many fakeouts.

So you need to trade wisely more than ever.

It means for example, betting against market consensus, which is uncomfortable but it’s usually the right trade.

You can also wait for bigger participation and moves.

The good news is the longer we trade like in recent weeks, the bigger eventual move should be.

Key level to watch from the downside is $28,500 before the important $27,500 - $27,000 area and key support of $25,000, where rally started on the announcement of Blackrock filing for BTC ETF.

On the other hand, from the upside, keep an eye on $30,050 and primarily on $30,500.

Lots of liquidity condensed in this region, as that’s where we’ve had subsequent lower highs, where sellers were stepping in aggressively to sell bulls’ attempts to push the market higher.

We would need to swipe that liquidity, and stay above $30,500 to expect further acceleration of the up-move to target ’23 high and beyond.

Have a great trading week ahead!

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.