Will BTC continue to stay within the range?

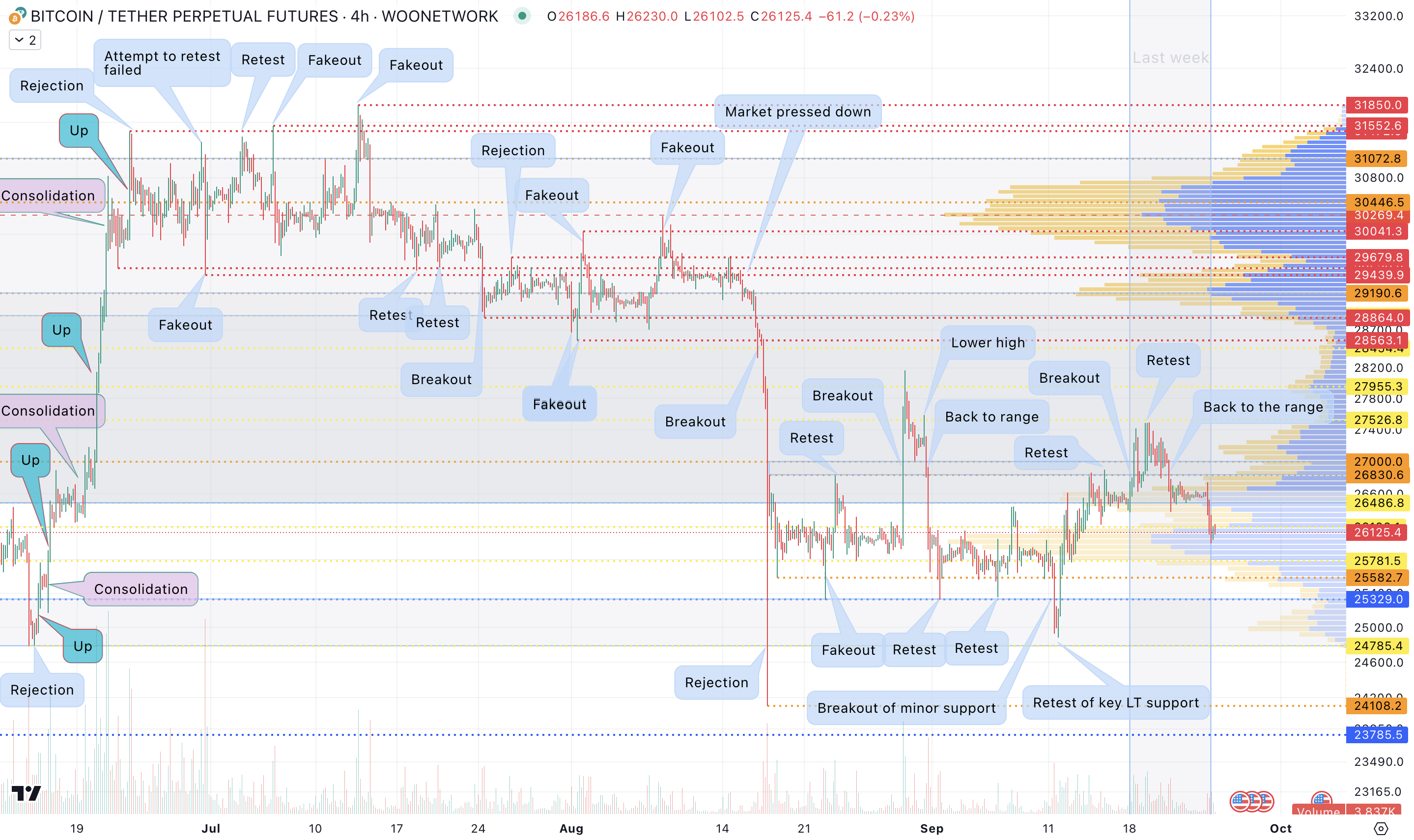

BTC entered last week continuing its strength from the week before.

It was bid up throughout the day, breaking $27,000 in the process and getting to as high as $27,400.

The move was driven mostly by leveraged accounts.

However, as it was consolidating below that level and the hearing on Binance vs SEC lawsuit started, the news hit the wires about SEC seeing an urgent need to inspect Binance.US.

That caused a knee-jerk reaction to the downside, squeezing weak longs and retracing a big part of Monday's up-move.

On Tuesday, we had another push to the upside, which was again perps-induced but $27,500 was strongly defended and momentum slowly changed to the downside.

Wednesday was a day with all eyes on Fed.

It announced its decision to keep rates unchanged as expected, but raised the median dot for ’24 by 50bps, trimming expectations for ’24 cuts from 100 to 50bps.

Powell was as hawkish as he could be during his presser, which led to sell-off in risk assets.

BTC was following equities down but it was quite resilient.

After Powell’s press conference, it retraced almost the whole post-FOMC move, squeezing shorts but wasn’t able to print a new daily high.

On Tuesday, we had crypto-positive news about MtGox repayment pushed by a year, which however didn’t cause any buying pressure.

As the market didn’t want to go up, it started to be pressed down following weakness in equities and record high yield on US TNote not seen since 2007.

As a result, BTC went down to retest the weekly low set on Monday at $26,370.

Then it bounced a bit to trade around $26,600 until late on Sunday.

As the end of the week and open on Tradfi futures were approaching, activity started picking up and BTC sold off to print a new low of the week at $26,000.

It eventually closed at $26,250 to finish the week slightly down.

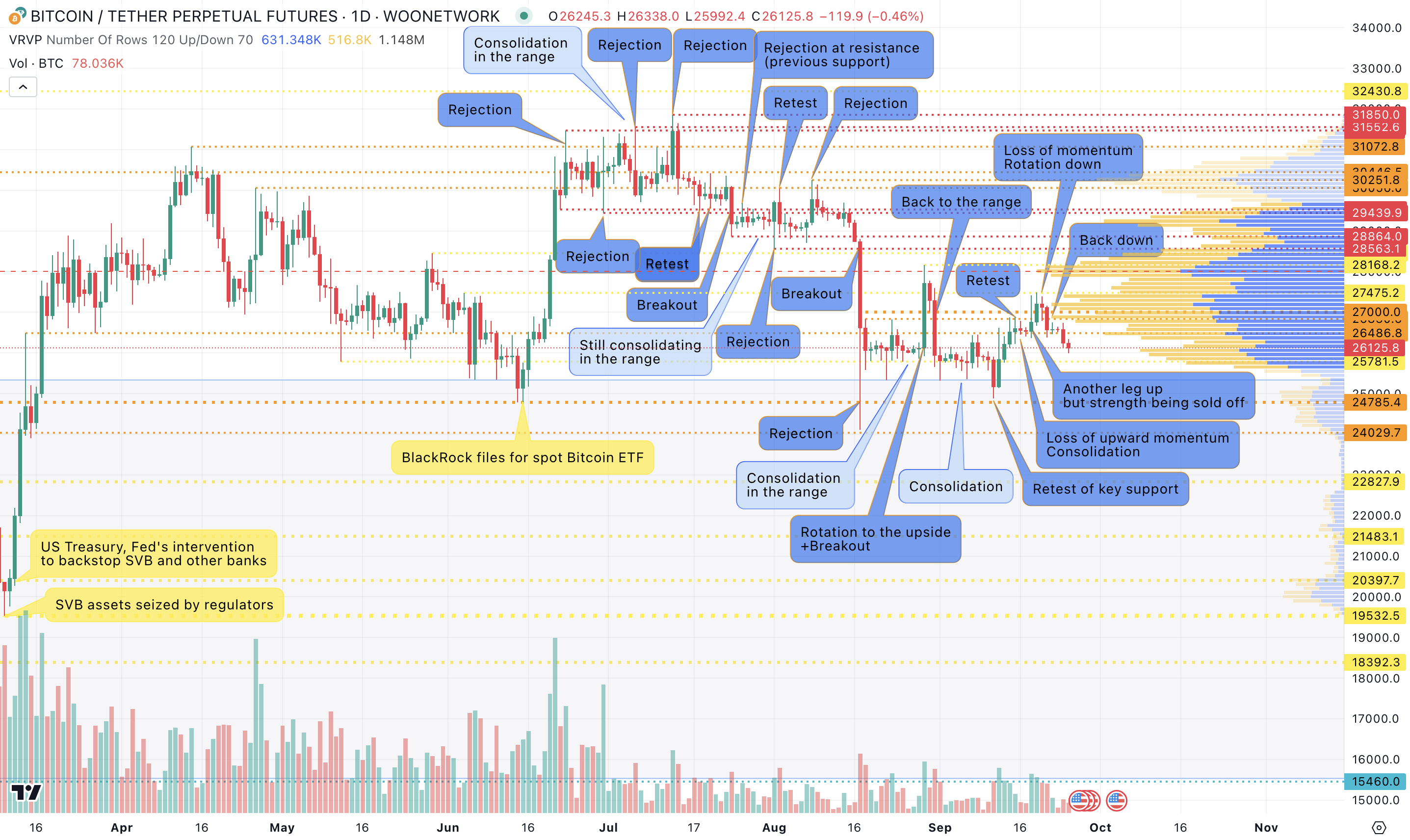

BTC is still staying in the range, for more than 5 weeks now with no directional resolution.

Early last week, we had another deviation above the $26,800 - $27,000 area, but eventually went back below.

Bulls had their chance to push the market decisively up, but it turned out to be unsuccessful.

From Sep 11, we saw aggressive buy programs entering the market intraday on almost every workday, but the last one was seen late in the US session after Powell’s press conference on Wednesday, Sep, 20.

Since then, momentum has turned to the downside, with sellers having the upper hand as BTC has been following risk assets down.

$24,800 and $28,000 are key levels to watch for now.

As long as they are not broken, it’s better not to be too much biased but rather look for intraday opportunities or swing trades, with up to a few day horizon within the range.

For now short-term momentum remains down.

On the way to $24,800, the first challenge from the downside is $26,000, followed by $25,800 and $25,300.

On the other hand, the immediate level to watch from the upside is $26,400, which had been supporting the market for more than a week until it finally broke overnight, and turned to resistance.

Then we have the $26,800 - $27,000 area followed by $27,500, which was strongly defended last week, before we get to the key $28,000.

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.