BTC started trading last week in the middle of a very tight weekend range.

It tested the highs of that range in the first hours on Monday, and started to be pressed down.

Earlier rumors about Huobi’s insolvency and investigations in China, and mounting pressure on USDT were weighing on the market.

Eventually BTC got sold off swiftly in the US session to $29,700, triggering stops in the process.

However, that was absorbed primarily by spot limit buy orders and BTC quickly came back, leading to a short squeeze – something we’ve seen many times before.

News about a new stablecoin launched by PayPal helped, together with USDT coming back towards par once fiat channels reopened.

After a breather, BTC bid up aggressively on Tuesday, as Moody’s downgraded several US regional banks, which was putting downward pressure on the stock market (esp banking sector) but helping BTC as a safe haven.

Also, later comments from Novogratz claiming that Bitcoin ETF approval is a matter of when and not if, and the Fed clarifying process for banks to transact in stablecoins supported BTC.

It broke previous week’s high and stops triggered above sent it to $30,250, but that liquidity was absorbed and we had strong rejection – same situation as we had on Monday but this time from the upside.

Since then, BTC was steadily moving down with any attempts to push it higher being sold off even stronger resulting in lower highs.

CPI release on Thursday was such a situation – slightly lower than expected y/y number (with m/m as expected) gave BTC an initial bounce which was later sold off.

Same on Friday, the news about the SEC delaying Ark Bitcoin spot ETF decision (which was expected) but calling for public input sparked some optimism and some buying pressure, which was later reversed.

Nonetheless, those moves were limited with BTC trading somewhere in the middle of the weekly range set by Monday’s low and Tuesday’s high. It finished the week mostly unchanged, only slightly up on the week.

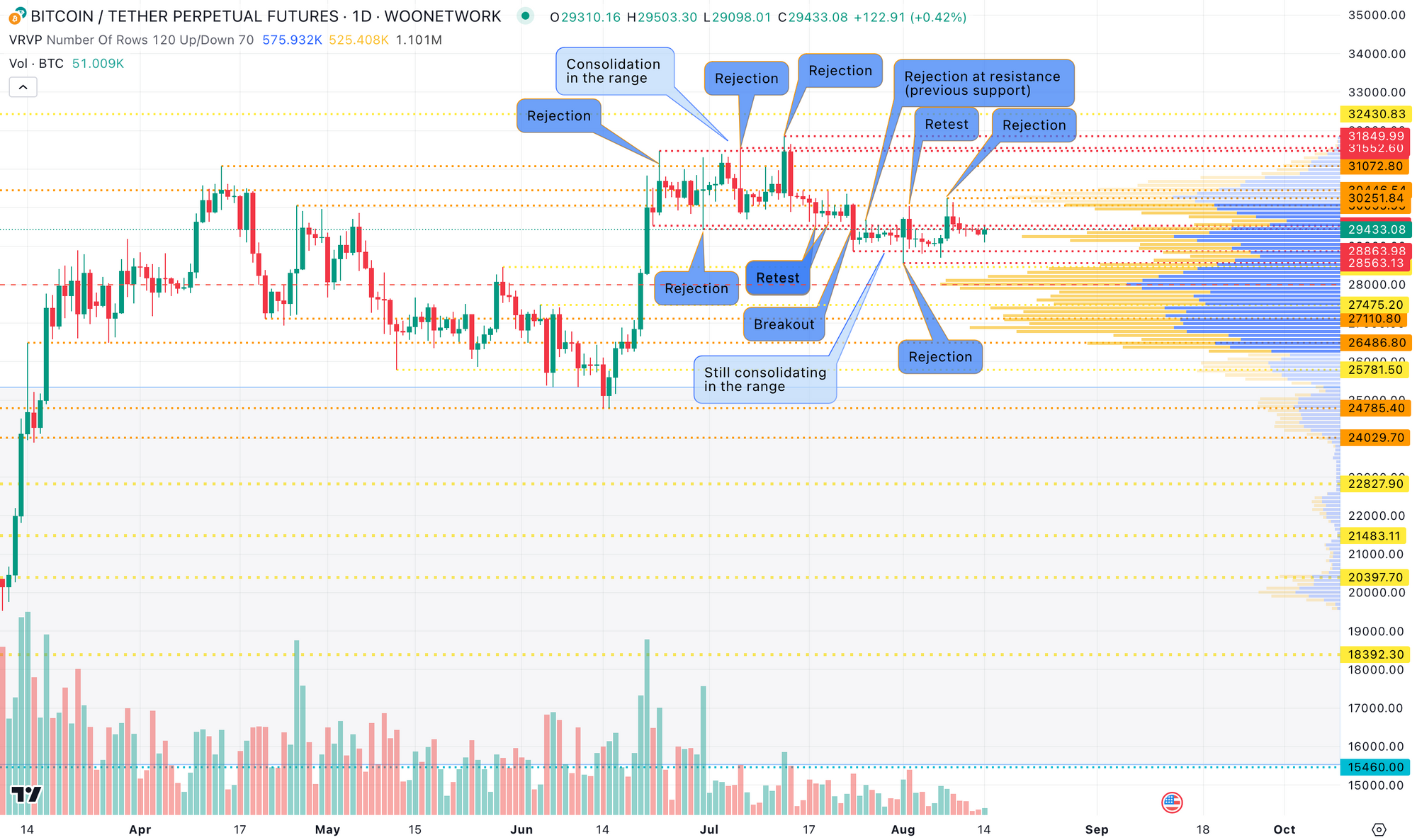

Last week didn’t change the BTC picture much, as we are still staying in the $28,500 - $30,500 range.

However, it's positive for bulls that it was the first week since ’23 high with not only a higher weekly low, but also a higher weekly high.

That’s a sign of bears losing steam and bulls trying to gain control – at least for now.

Nonetheless, the fact that there was no follow-through to the upside, but instead we had rejections, shows that the market remains well-contained.

As noted last week, to be confident about the long side, it’s key to break $30,500.

From a shorter-term perspective, targeting liquidity is still the main play on this illiquid market.

Looking at major moves last week, they unfolded similarly – selloff to trigger sell stops below important support -> short squeeze all the way up -> trigger buy stops above major resistance -> long squeeze by pressing the market down.

Even the timing was similar with those major moves happening between Monday and Wednesday, and then being relatively quiet from Thursday till Sunday.

Even major macro data hasn't been affecting the market much in recent weeks.

On top, initial moves on key releases have been absorbed and reversed in most cases.

That shows the significance of taking price behavior into account while making trading decisions and not just the data itself (whether it’s bulling or bearish).

It’s important at the same time to keep emotions at bay, not fomo in as you can easily get trapped, but instead follow recurring patterns, although they are usually hard to execute from a mental perspective.

All the best, and have a great trading week ahead!

Trade now on https://x.woo.org/ and follow @KTGglobal for more trading insights.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes to their investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.