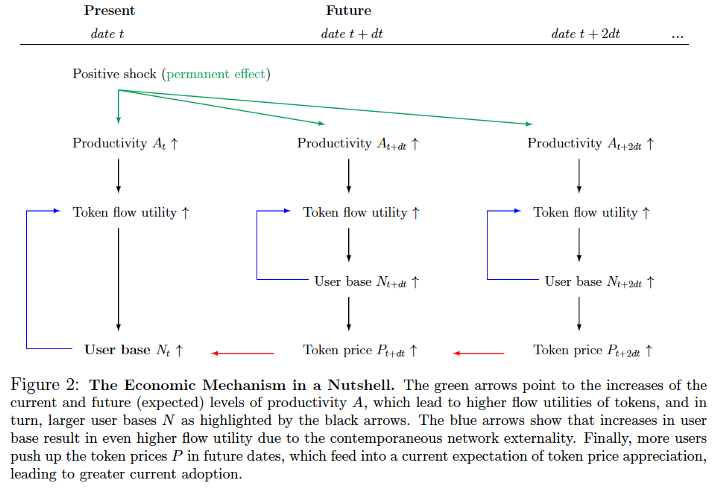

The ultimate purpose of the tokenomics is to design a token based system that will achieve this positive reinforcing cycle by carefully developing things like initial token distribution, price stability systems, governance system, and future adaption policies.

In addition, the currency operational tasks that are normally handled by central banks and/or commercial banks are also incorporated into the tokenomics of the cryptonetwork. As the chart below shows, the various tasks relating to currency settlement, ledger maintenance, and network security are all simply incorporated into the code of the cryptonetwork itself. These operational tasks do not get the same publicity as the high-level monetary policy related functions. However, these are all critical parts of a stable and well-functioning monetary system. These are all things that must be accounted for in the tokenomics of the platform. If there is one area in which cryptoneworks/blockchain based systems have clearly proven their product/market fit, is in the operational tasks of a currency. The 6 tasks that are currently managed by central and commercial banks can simply be translated into lines of code and work just as effectively on a blockchain based system.

Crypto Stablecoins

Stablecoins were first introduced to the space due to the demand for a stable medium of exchange because the inherent volatility of the cryptocurrencies like Bitcoin made it impractical to use as a medium of exchange. Stablecoins are able achieve its price-stability through a peg against a fiat currency or a commodity and through collateralization through other cryptocurrencies. The fiat currency backed stablecoins have had an especially significant impact because it introduced a new connection between the legacy world and cryptonetworks. Fiat on ramps are available but the high intermediation costs on the exchanges that offer fiat on ramps combined with easy exchangeability of the currency based stablecoins between most large exchanges made the currency backed stablecoins a superior option for investors.

US dollar stablecoins have dominated the marketplace with roughly $290 billion dollars of US dollar backed stablecoins moved on-chain in the past year alone. Tether issued USDT remains the dollar backed stablecoin market leader with the BTC/USDT trading pair still representing 90% of all BTC traded with stablecoins; this despite the lingering rumors that USDT’s remain undercollateralized.

Like most products in crypto, stablecoins are a traditional financial product built on blockchain infrastructure. Stablecoins are just another peg currency but the significant difference (aside from that is blockchain-based) is the fact that the authority that ultimately ensures the stability of the currency is not a monetary authority/central bank but an independent organization. For example, USDT is issued by one organization, Tether, whereas USDC has multiple issuers that have a license to issue USDC tokens. The peg is maintained by investors that arbitrage the differences between a pegged rate and the secondary-market rate rather than an intervention by the central bank.

Sources:

McLeod, Saul. (2018) “Skinner-Operant Conditioning” https://www.simplypsychology.org/operant-conditioning.html

Cong, William et all (2018) Tokenomics: Dynamic Adoption and Valuation https://bfi.uchicago.edu/wp-content/uploads/WP_2018-49.pdf

Lyons, Richard and Ganesh Viswanath-Natraj (2020 April) “What Keeps Stablecoins Stable?” https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3508006

Cacioli, Lucas “Stablecoin On-Chain Activity at Record Highs but Will Crypto Market Inflation Follow?” https://blockchain.news/analysis/stablecoin-on-chain-activity-at-record-highs-but-will-crypto-market-inflation-follow.

Kapilkov, Michael (2020 April) “Stablecoin Activity Grows 800% in One Year” https://cointelegraph.com/news/stablecoin-on-chain-activity-grows-800-in-a-year