article by CryptoJelleNL

As we discussed in our previous article, monetary policy has taken a step into the spotlight lately, with many crypto traders paying attention to what Jerome Powell and Janet Yellen have to say. We discussed quantitative easing, an expansionary monetary policy meant to boost the economy; and how excessive use of quantitative easing can result in other challenges, such as high inflation.

High inflation is precisely the challenge many economies face today, which is why central banks look to quantitative tightening to bring inflation back to their preferred levels.

In today's article, we dive deeper into the concept of quantitative tightening, how it works, and how it affects crypto markets. Read on to learn everything there is to know about QE's contractionary counterpart.

What is quantitative tightening?

Quantitative Tightening is a division of monetary policy aimed at reducing the amount of capital (the money supply) in an economy. While each central bank approaches it slightly differently, it generally boils down to selling bonds or letting them mature.

The sale of bonds adds supply to the bond market, resulting in higher yields (interest rates) to entice buyers. The higher these interest rates go, the higher the cost of borrowing. As we discussed last week, the cost of borrowing directly influences economic activity – where lower interest rates result in more investment and spending, and higher interest rates reduce investment and spending. The relationship between interest rates and economic activity exists because the higher interest rates go, the more attractive it is to save money, and the less attractive it is to borrow.

The large-scale selling of bonds further reduces economic activity, because it removes liquidity from the financial system. With less capital to go around, businesses and households have to spend their money more carefully.

In theory, these reductions in economic activity reduce inflationary pressures in the system, which is why QT is generally considered a form of contractionary monetary policy.

Why is quantitative tightening used?

In most cases, Quantitative tightening is used to bring down inflation. Central Banks exist to keep an economy running as efficiently as possible, and runaway inflation is seen as a cog in the economic wheel. After all, high inflation increases costs for households and businesses, which can hurt the economy if left unaddressed.

The first and most commonly used tool to bring inflation down is increasing the central bank interest rate (for example, the Federal Funds Rate), but in some cases, the situation calls for more aggressive intervention.

In these cases, quantitative tightening can be the sledgehammer central banks need. As discussed earlier, QT involves selling bonds, or letting them mature, which results in higher interest rates, less circulating capital in the market, and a decrease in economic activity.

The decrease in economic activity is exactly what central banks need to bring inflation back to normal levels.

Quantitative tightening vs tapering

Tapering is widely considered to be an element of quantitative tightening, while in reality; tapering is where quantitative easing is wound down. It is the transitionary period between QE and QT, where asset purchases are decreased until they are zero.

For example, instead of pumping 500 billion dollars into the economy, a reduction to 350 billion dollars of capital injections would be considered tapering – even though the central bank still injects 350 billion dollars into the economy. Essentially, tapering is still a form of expansionary policy; just at a reduced pace.

Economists like to use the analogy of taking your foot off the gas. The car will slow down, but you're not exactly slamming the brakes just yet.

Generally speaking though, the goal of tapering is to end a period of expansionary policy, with a period of restrictive or contractionary policy following soon after.

Quantitative tightening in 2022

When inflation got out of hand in 2022, the Federal Reserve announced a package of restrictive monetary policy decisions, aimed at cooling the inflationary pressures. In addition to the 9 consecutive rate hikes over the past year, the Fed decided they would let approximately one trillion dollars worth of securities mature, without reinvestment, resulting in a reduction in economic activity similar to the effect of a 25 basis point rate hike.

While the Fed's fight with inflation is far from over, it is clear that their measures are working.

Quantitative tightening risks

Just like QE, quantitative tightening is not without risks. Central banks have to carefully remove liquidity from the system, without completely destabilizing the economy and crashing financial markets. This has happened before, where a mere mention of potential tightening caused massive volatility in treasury yields and a drop in bond prices.

Another problem with QT is that generally speaking, the central bank quits the tightening program before it is complete, because of how the stock markets react to the tightened policy. This happened after the 2008 crisis, when the Federal Reserve had to halt QT, and resorted to another round of QE to ensure the stock market did not collapse.

The same can be seen today, as the markets have sold off significantly since the start of the current, more restrictive global monetary policy. As we discussed in our recent article on QE, policymakers in certain countries have already fired up the QE engines again.

Nevertheless, QT is generally considered a great tool to slow down an economy, but navigating its balance is very tricky.

Quantitative tightening and markets

History has demonstrated a relationship between monetary policy and financial markets. Expansionary policy and quantitative easing generally push asset prices higher, whereas restrictive or contractionary policy generally drags prices lower.

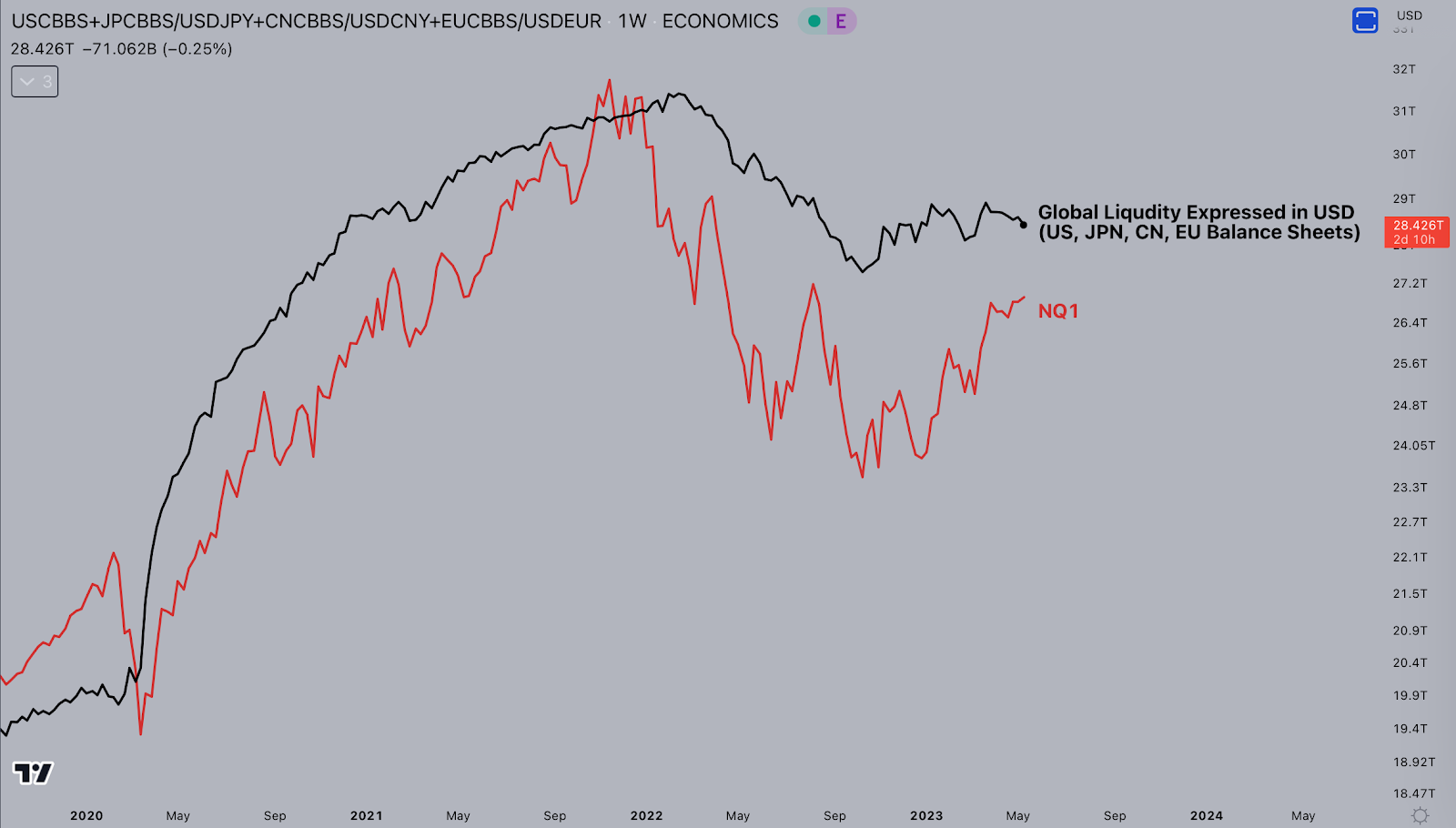

The below chart shows global liquidity conditions (the cumulative balance sheets of the United States, Japan, China, and the EU), and the performance of the Nasdaq 100. The chart shows how the markets rally while the balance sheets expanded, and how they quickly came down when the balance sheets dropped.

It also shows the market reacts even more strongly to tightening, than it does to easing conditions.

As you can see, the Nasdaq 100 peaked just weeks before the end of QE programs across the world, coming down just as fast as it came up. The same relationship between global liquidity conditions and asset prices is observed in Bitcoin, which also strongly reacts to both QT and QE. All in all, global markets seem to be closely correlated to global liquidity conditions.

This correlation underlines the idea of hard assets acting as a hedge against inflation. Money supply increases push up the markets, whereas a contraction in money supply pushes the market back down.

What is next?

After a period of clear tightening, global central banks seem to be in disagreement on what's next. On aggregate, the balance sheets remain unchanged, while on an individual level, we see a lot of action.

Most notably, China has made smaller-scale capital injections ($92 billion of reverse repurchase contracts in February 2023, for example), while the economic situation in the United States may soon call for a new expansionary policy as well.

Closing thoughts

In sum, Quantitative Tightening is a program used by central banks to slow down the economy, when increasing interest rates does not make a sufficient difference. With QT, governments sell bonds on a large scale or let them mature - as a way to reduce capital availability and push interest rates.

Quantitative Tightening also seems to affect global markets, with the most recent campaign triggering a sell-off in various asset classes. Markets are currently consolidating as central banks weigh their next moves.

Predicting these moves is incredibly difficult - but it is still worthwhile to study what central banks are up to, as it will help you generate a better understanding of why markets move the way they do.

Author's Disclaimer: This article is based on my limited knowledge and experience. It has been written for informational purposes only. It should not be construed as investment advice in any shape or form.

Editor's note: CryptoJelleNL provides insights into the cryptocurrency industry. He has been actively participating in financial markets for over 5 years, primarily focusing on long-term investments in both the stock market and crypto. While he watches the returns of those investments roll in, he writes articles for multiple platforms. From now on, he will be contributing his insights for Alpha Circle as well.

Check out his twitter: twitter.com/cryptojellenl

—

The content above is neither a recommendation for investment and trading strategies nor does it constitute an investment offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.