Themes, statistics, and analysis from the first quarter of 2022.

WOO Network has jam-packed the first quarterly report of 2022 full of insights and updates. This report includes progress on WOO X product launches, new developments for WOOFi, updates on the WOO token, and growth across WOO DAO and the community.

Looking back on Q1, the crypto-asset market faced significant headwinds. The leading headlines included international conflict and geopolitical tension, monetary policy tightening by central banks through initial rate hikes, dislocations in commodities markets like oil and nickel, and exploits of several large DeFi protocols like Wormhole and Ronin. These adverse trends translated into material drawdowns across all crypto sectors in early Q1.

Despite these negative events, sentiment across the crypto market began recovering in the second half of Q1. Alongside asset prices recovering, trading volumes and yields started to pick up. Most prominently, there were several large equity raises by crypto startups that included participation from traditional investing giants like Tiger Global and Brevan Howard. The Luna Foundation raised 1 billion to back UST with Bitcoin reserves, which helped support growing tailwinds in late March. Several Metaverse and GameFi funds were launched and Yuga Labs, the group behind Bored Ape Yacht Club, acquired Crypto Punks IP, launched ApeCoin, and raised $450M.

Locking in the WOO narratives

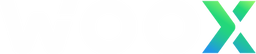

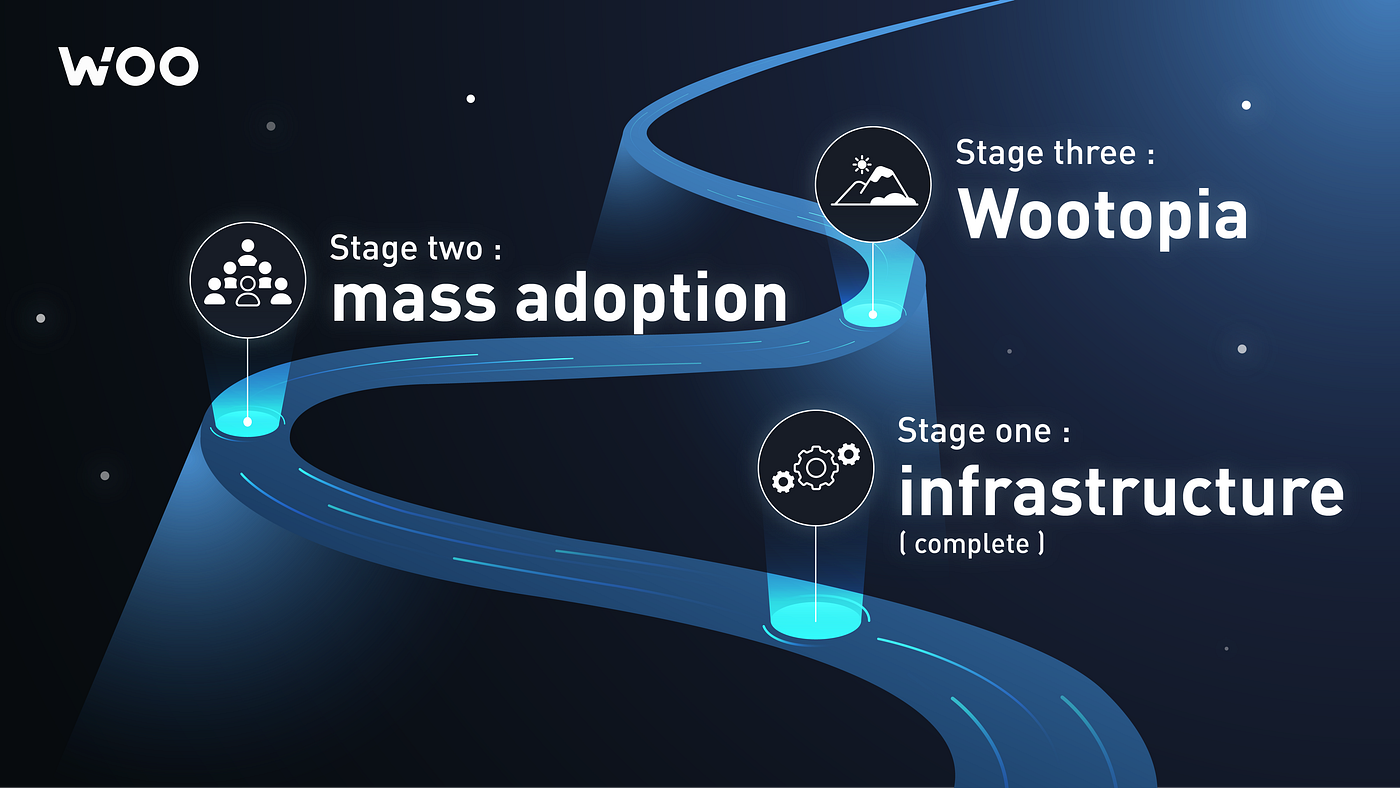

Stage 1: Building more efficient market infrastructure [complete]

WOO Network ended Q1 with a significant milestone, launching the first zero-fee futures markets on WOO X. From a CeFi product standpoint, there are now futures markets, spot markets, spot margin, API-trading and subaccounts, WOO X (graphic user interface), WOO X mobile (iOS and Android), plus a host of facilitating services like staking, wallets, vaults, and more. This creates the foundation of the centralized framework needed to satisfy the needs of most active traders and signifies a shift in the evolution of WOO Network development.

In DeFi, WOOFi has already launched a decentralized swap, pricing oracle, staking module, and yield optimizer, running on multiple blockchain networks.

Stage 2: Optimizations and mass adoption [in progress]

The next shift will see a focus on growing the user base and trading volumes by shortening onboarding times, localizing WOO X for more regions, seeking more licenses to unlock new markets, building features (such as fiat onramps) that service a wider range of users, and marketing to a larger audience. In addition, adding products that attract more users, such as yield products and the first elements of social trading. Increasing market share is now a top-level company priority, as measured by users and volume on WOO Network.

Stage 3: Reaching ‘Wootopia’ [underway]

The key third shift will be driven by innovation, leading to products that build off the infrastructure from stages one and two but do so by embracing the untapped potential of Web3 technologies. On-chain spot and derivative markets, multi-chain products, decentralized reputation systems for social trading, and the gradual merging of experiences across WOOFi, WOO DAO, and WOO X. This will create a more disruptive network, and fulfill the initial WOO Network missions of empowering individuals through democratized access to markets. Stage 3 design has already begun and will have some important announcements later in Q2.

WOO X updates

- WOO X Futures

- Trade-to-earn (T2E)

- Subaccounts

- Added Traditional Chinese, Turkish, Russian, Portuguese, and Ukrainian language support

- “Whales of WOO” VIP program

- LUNA, LOOKS, ONE, BTTC, LEO, APE, IMX, GMT, and HBAR were added to WOO Network. Currently, WOO X supports 97 trading pairs available for manual and API trading. WOO X Futures launched with 20 trading pairs (15 more were added early in April).

WOOFi updates

- Launch of WOOFi Earn, Swap, and Stake on Avalanche

- Multichain dashboard (BSC & Avalanche)

- 27 earn vaults and over $11M in TVL

The WOO token

All statistics in this report are accurate as of April 5th, 2022.

- The circulating supply is 1,011,344,919, which accounts for 33.8% of the 2,987,855,221 total supply. The market capitalization ended at $1.01B, which was roughly the same as the end of Q4, 2022.

- There are now over 24,802 unique on-chain addresses spanning the Ethereum, BSC, Polygon, Fantom, HECO, and Avalanche networks. This on-chain user base increased 18.5% from the previous quarter. In addition, there are 3542 xWOO holders on BSC and Avalanche.

- In CeFi, the largest markets by WOO holdings are WOO X (~178M WOO), Binance (~60M WOO), KuCoin(~33M WOO), OKEx (~17M WOO), and AscendEx (~11.8M WOO).

- Over 309M WOO tokens are currently staked across WOO X, institutional staking, and WOOFi, which represents a 31% increase from Q4. There are 4,527 retail users with at least 1,800 WOO staked, an increase of 30% from Q3.

- WOO was listed on Binance, Kraken, and Bitfinex.

Token statistics

The circulating supply increased by 132m WOO this quarter, driven by the ~56m WOO tokens which were used as collateral but must be returned to the locked liquidity management wallet in the future. For the remaining ~76m WOO tokens, about 45m were claimed by seed investors, as their vesting wallet now contains only 2.7% of the supply and is set to complete this fall. The remaining increase was due to ecosystem rewards, staking rewards, exchange listing marketing rewards, team and equity investor vesting, WOO Ventures investments, and advisor vesting.

For Q4, the WOO token burns were as follows:

- January: 669,814

- February: 1,888,108

- March: 1,686,780

- Q1 Total: 4,244,702

- Total: 13.8M

Talent acquisition and human resources

- The organization growth rate of WOO Network is 29.5% from Q4 of last year, with now over 120 employees worldwide.

- A new office started fully functioning in Warsaw, Poland. Key hires were made in Turkey.

- WOO DAO launched a job board. Members can now refer their talented friends and get rewards from the DAO treasury.

- WOO Network is actively hiring and looking for TAM specialists to help make WOO Network the desired place to work. There are over 45 current openings at https://boards.greenhouse.io/woonetwork.

Legal and compliance

- To comply with Turkey’s regulatory requirements, WOO TR was independently established. It will specifically serve Turkish crypto traders, involving relevant KYC, a fiat gateway, and invoice processing.

- Full support of compliance for WOO X Futures in each region serviced.

- The continuous optimization of the KYC and KYB process, including support for more ID types and changing the facial recognition service provider for more efficiency.

- Compliance plans for Germany, Liechtenstein, and Taiwan regulators are underway.

WOO DAO

WOO Network launched WOO DAO in late Q4 to increase active community participation, form partnerships with leading DeFi applications and protocols, fuel growth across the WOO ecosystem, and enhance the WOO token’s utility. Throughout Q1, WOO DAO completed several major initiatives:

- Launched Treasury, Growth, and BD committees where contributors can participate to help WOO DAO achieve its objectives. There are over 15 dedicated community contributors across the committees, plus many more casual participants.

- WOO Force was launched to help WOO Network grow globally, with more than 30 participants in the first cohort.

- Established a governance structure using WRCs for proposals, community calls for discussions, and WIPs for formal voting.

The Treasury committee partnered with several protocols to deploy 5M WOO, representing 1.7% of the total WOO in the treasury.

- Providing liquidity on Uniswap’s WOO/ETH and WOO/USDC pools

- Providing single-sided liquidity on Bancor’s WOO pool

- Launched covered call vaults with ThetaNuts, which included building customized vaults

- Creating a bonding program for AVAX/USDC LP tokens with Olympus Pro

Looking ahead to Q2, WOO DAO aims to continue forming partnerships with leading networks, DAOs, and DeFi applications that contribute to WOO Network ecosystem growth and increase the WOO token’s utility. WOO DAO encourages all WOO token holders to attend the weekly community calls on Wednesdays at 3:00 pm UTC. Additionally, for token holders staking more than 1,800 WOO on WOO X or WOOFi, you can register to vote on WIPs in the WOO DAO discord.

Community

Currently, WOO Network has 16 local communities with regional Korean, Nigerian, Dutch, Ukrainian, and Thai communities added in Q1. The total members were up to 127K members, an increase of 20%. WOO Force is spearheading this growth and will facilitate brand awareness, content distribution as well as events and local activities in different parts of the world, alongside the WOO Network team.

The local groups can be found on Discord and Telegram:

- 🇹🇷 — https://t.me/woonetwork_tr

- 🇸🇦 — https://t.me/woonetwork_ar

- 🇷🇺 — https://t.me/woonetwork_ru

- 🇵🇱 — https://t.me/woonetwork_pl

- 🇺🇦 — https://t.me/woonetwork_ua

- 🇪🇸 — https://t.me/woonetwork_esp

- 🇳🇱 — https://t.me/woonetwork_nl

- 🇧🇷 — https://t.me/woonetwork_pt

- 🇳🇬 — https://t.me/woonetwork_nigeria

- 🇰🇷 — https://t.me/woonetworkkorea

- 🇻🇳 — https://t.me/woonetwork_vn

- 🇹🇭 — https://t.me/woonetwork_thai

- 🇮🇳 — https://t.me/woonetwork_ind

- 🇮🇩 — https://t.me/woonetwork_ina

- 🇨🇳 — https://t.me/woonetwork_cn

- 🇹🇼 — https://t.me/woonetwork_tw

For more info, be sure to follow us on social media:

- Reddit: https://www.reddit.com/r/WOO_X

- Website: https://woo.org

- Twitter: https://twitter.com/WOOnetwork

- Discord: https://discord.gg/woonetwork

- Telegram: https://t.me/woonetwork

- Telegram Announcements: https://t.me/woonetworkann

- Medium: https://medium.com/woonetwork

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.