WOO X becomes the first crypto exchange to launch its live self-reporting dashboard, which the company developed with the goal of making crypto exchanges more trusted than traditional finance (TradFi).

Various solutions have been put forward after the collapse of many centralized crypto service providers, but these lack the complete picture to truly verify the complete risk profile of assets on a platform. WOO Network’s transparency dashboard, http://woo.org/proof-of-reserves/, includes; live data reporting that updates every 15 mins; proof of assets and where they are held; information on liabilities; an FAQ section; and a section listing the company’s further plans to show transparency.

We’ve decided to take the approach to maximize transparency and timeliness, aided by on-chain proofs wherever possible, with the following principles in mind:

- Real-time, verifiable information on assets and liabilities

- Over-collateralization of assets to liabilities to act as a buffer

- External auditing and verification of completeness and accuracy of the methodology

- Conservative and diversified holdings on liquidity venues (such as Binance / OKX)

- Embracing DeFi and non-custodial trading as a fundamental solution to counterparty risk

How to read the dashboard

We don't believe that users should rely on centralized entities to manage the risk for them. Instead, they should have verifiable data to make their own informed decisions.

Below is a summary of the different modules on the dashboard.

Reserve Ratio

An obvious place to start is the reserve ratio, which compares the number of user assets and cash reserves WOO X has in relation to its user deposit liabilities. A reserve ratio above 100% means that all user deposit liabilities are backed 1:1 by assets on WOO X, as well as its cash reserves and insurance fund.

Custody Ratio

This ratio is the total amount of WOO Network's cash reserves, insurance fund, and users' assets held in third-party custodians or cold storage divided by the total amount of users' deposit liabilities. Reserves on WOO X are separated between being used to aggregate deep liquidity, held in active storage, and secured in institutional custodians such as Fireblocks. This diversifies risk, including a loss to hack or other counterparty risks.

To increase confidence from users, WOO X will strive to keep a safe custody ratio greater than 75%. This rate will also allow us to maintain our deep liquidity and zero-fees value proposition for our users.

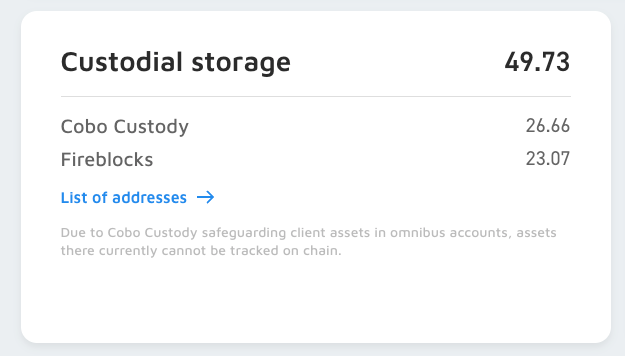

Custodial Storage

WOO Network utilizes multiple dedicated institutional-grade custodians to safeguard users' assets while reducing central points of failure. A breakdown of our custodians can be found on the dashboard. Fireblocks, for example, can be viewed on-chain. Currently, WOO X is working with Cobo Custody to have dedicated addresses making all funds visible on-chain.

Liquidity Sources

WOO X has a hybrid approach that utilizes third-party venues for aggregating liquidity and hedging. This requires a radical approach to transparency, and as such we display the number of assets allocated to each venue using APIs that update every 15 minutes. The creditworthiness of venues is monitored 24/7/365 to minimize counterparty risk.

Liabilities

Our liabilities statement includes all users' deposit liabilities on WOO X. Surprisingly, only 7 out of the top 51 crypto exchanges are showing their liabilities statements on their websites.

The User Balance column refers to the user positions on WOO X. The User Margin column is the sum of negative balances for users, which can be deducted to find the total liability.

You may sometimes find that there’s a token mismatch between the assets and liabilities. This is because some of the delta-neutral hedging activities utilize futures to hedge underlying spot positions in order to provide better execution quality to our users. WOO Network is holding assets and positions against user liabilities. The strategy is strictly hedging with very tight risk limits.

On top of the live dashboard, WOO Network’s Terms of Services ensure that users are entitled to the benefits of the senior creditors to the extent acceptable under the law. This legal language is crucial for determining the safety and retrieval of users’ funds in the worst-case scenario.

FAQs and more

Moving forward, WOO Network is working to implement Merkle Tree proofs to verify all WOO X user assets are accounted for in liability calculations. Merkle Trees allow users to cryptographically verify that their balances are included in the complete snapshot of liabilities. Moreover, WOO Network aims to complete a financial audit by a reputable, independent third party to verify the data reported is accurate and complete.

We have also included an FAQ section, check it out here.

The content above is neither a recommendation for investment and trading strategies nor does it constitute an offer, solicitation, or recommendation of any product or service. The content is for informational sharing purposes only. Anyone who makes or changes the investment decision based on the content shall undertake the result or loss by himself/herself.

The content of this document has been translated into different languages and shared throughout different platforms. In case of any discrepancy or inconsistency between different posts caused by mistranslations, the English version on our official website shall prevail.